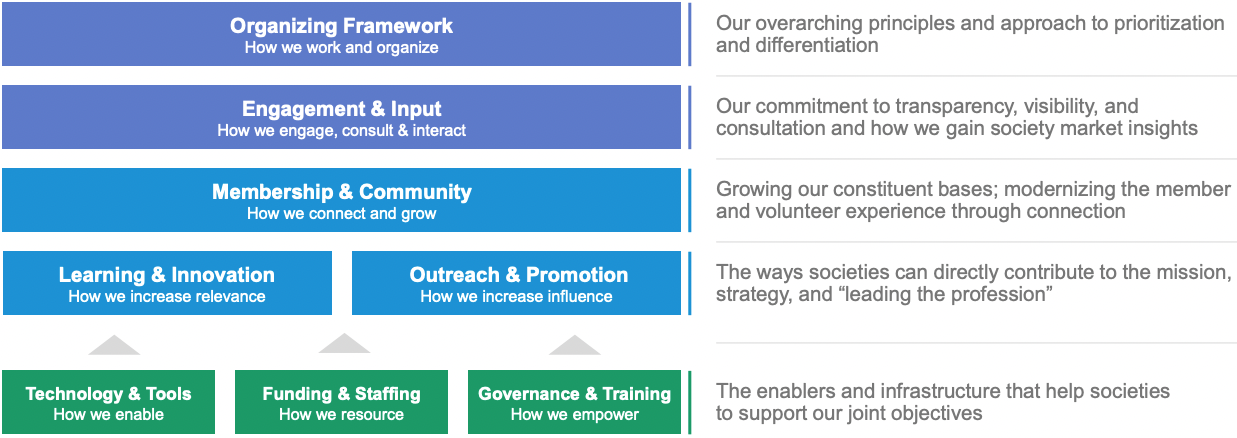

A year ago, we began work on a Society Operating Model, a strategy to optimize the strengths of our global network and better enable our mission to serve our collective members today and tomorrow. Below is the graphic you may be familiar with that shows the components of the Model shared in September 2021. This will continue to guide us.

Over the course of the last fiscal year, we have progressed each of these components and refined our overall approach based on extensive analysis and discussions with society leaders. We present information about an essential piece—the Organizing Framework—that describes our proposed differentiation of the network for purposes of driving increased value. We expect this approach to differentiation will underpin the other components of the Society Operating Model.

What are we really trying to achieve? Well, when we look ahead 10 years, we aspire to a world in which a few things are true:

-

CFA Institute and society membership has more than doubled!

-

We have strong footholds in major financial centers and economies, as well as in developing markets where the CFA® Program will have grown significantly

-

Members enjoy rich learning experiences and premier content, and are connected to their peers and communities of interest locally and around the world

-

The CFA Institute community is the go-to place for dialogue on the urgent issues facing investors

To achieve that vision, our plan is three-fold:

-

Effectively and responsibly share resources today

-

Catalyze high performance in support of mutual goals

-

Lay the foundations for a growing and connected membership base

WHAT WE’VE LEARNED ABOUT THE GLOBAL SOCIETY NETWORK

To inform the Society Operating Model and refine it over the past year, we conducted an extensive analysis of the network. We looked at business models and activities, identified through our relationships with all of you and through society business plans and year-end reports; various macroeconomic factors; how resources like staff and funding are used; and strategic plan alignment. We confirmed a few things:

-

Society and CFA Institute strategies are well aligned. Societies are well positioned to serve local members and candidates, building influence in their markets, advancing thought leadership, and, among some, even developing original learning offerings.

-

Our structure has evolved. We’re maturing from a hub-and-spoke model with CFA Institute at the center, to the more interconnected and interdependent network that is beginning to emerge.

-

Roles vary across the network. Markets are unique and diverse, and how societies support their markets varies widely. Our current “one-size-fits-all” approach to support leaves a lot to be desired; for some, there is too much complexity and too many unreasonable expectations, and others find themselves underfunded and expectations to be too simplistic. CFA Institute can better reflect those differences in our support.

-

Society operational funding and indirect resources favor smaller societies. Current operational funding ranges widely from less than $50 to more than $500 per member, with the smallest societies at the high end.

-

Technology enables more connection. Societies banding together to host events has amplified value for members. Meanwhile, societies increasingly seek connection as a global community.

A PROPOSED MODEL FOR SOCIETY DIFFERENTIATION

Based on our analysis, we put together a preliminary proposal of what we believe are three unique society segments, and the roles they play within our global network and their local markets:

-

Local/Member Societies—Small, city- or state-based societies that serve local investment communities of members and may participate in some other activities (e.g., outreach to candidates, localized community campaigns).

-

Professional Associations—Large, city-based societies and most countries that do everything that local societies do and have wider opportunities to influence key stakeholders and support CFA Institute strategic objectives.

-

Global Financial Centers—Critical financial markets that house the bulk of the investment management industry. These societies can support major strategic initiatives, and are often equipped to develop thought leadership, products, and/or support institutional relationship building.

No group is deemed better or more important than another to the ecosystem, but this approach takes a realistic look at the natural scope of influence and impact of different markets, and the similarities, differences, and complexities that exist for societies. Some additional nuances exist by region and country (e.g., China, India, and North America) that will require special attention to realize opportunities at hand.

More information about the expected roles, proposed metrics, and funding model can be found within the detailed version of the Society Operating Model on Society Center (Society Operating Model tile).

WHAT THIS MEANS FOR SOCIETIES AND MEMBERS

We expect to use the final differentiation model as the foundation for evolving other key components of the Society Operating Model—specifically, the role societies play in advancing Learning & Innovation and Outreach & Promotion as a way of directly contributing to our mission and strategy. This will be reflected in the model’s Service Standards & Metrics, and resources provided by CFA Institute related to Funding & Staffing and Technology & Tools will also be differentiated.

Society Involvement in the Process

First and foremost, we are not making these decisions unilaterally. To do what’s right for the network, we need to do what’s right by the network. That means approaching our plans in consultation with society leaders and their representatives. The Society Operating Model has been discussed with Presidents Council Representatives and reviewed by both the Society Partnership Advisory Council (SPAC) and the Board of Governors throughout its evolution. All groups have provided valuable feedback that has refined our thinking. Next, before, during, and after the SLCs, we will seek input from society leaders on the segments, expected society services and metrics, high-level funding approach, and key enablement resources.

Organizing Framework: How We Work and Organize

Some small societies may also find partnerships with other nearby societies to be mutually beneficial and will be encouraged to explore those opportunities. While changes to our footprint—that is, the number of societies—are not strictly necessary, there may be long-term benefits to members in some markets for their societies to pool resources and simplify operations.

As new ways of delivering value to members emerge to complement current approaches, we will work with societies to consider natural collaborations or even formal mergers. We expect simplifying the expectations and workload on volunteers of small societies will have significant appeal. That said, we will work to preserve the spirit of volunteerism core to societies and the value our collective members perceive from their local affiliations. Society Relations and PCRs have begun to discuss these ideas with some sub-regions and find many societies are interested in at least exploring such arrangements.

Learning & Innovation and Outreach & Promotion: How We Increase Relevance and Influence

We have drafted tailored expectations for each segment in the form of expected Society Services & Metrics. In many cases, these expectations reflect how societies in each segment are already performing.

On the Learning & Innovation side, for example, large societies in critical markets (e.g., Global Financial Centers) may be formally expected to help develop products or convene thought leaders on emerging topics—these aren’t activities most small societies can easily do on their own. When it comes to Outreach & Promotion, we expect most, if not all, societies are equipped to do some local outreach and community building, and mid-sized and larger societies are able to build connections across their regions, promote codes and standards, and support candidates, among other activities.

These expectations aren’t meant to serve as constraints or limitations on activities, but rather clearer guideposts to help society leaders align business plans more readily to the CFA Institute strategy against their local capacity and objectives.

Funding & Staffing: How We Resource

As we think about shared resources including volunteer time and passion, our aim is to preserve and incent strong performance and grow the impact we can have through our partnership with societies. Our approach today doesn’t meaningfully reflect impact. Especially in a resource-constrained environment, we must be mindful of how we’re distributing all resources to better balance need against potential for greater impact. In most markets, we expect to continue to allocate the variable incremental funding you’re used to based on the number of members and candidates. As of now, we expect the base amount may be differentiated as well, based on segment.

We also propose a performance-based component for mid-sized and large societies (e.g., Professional Associations and Global Financial Centers). This would preserve, and in some cases increase, the funding opportunity for societies in larger markets. Revenue share opportunities for these mid-sized and large societies have been factored in. And as we have in the past, we will invest Strategic Funding in certain high-impact markets (e.g., Professional Associations) where infrastructure or senior professional staff is required.

Technology & Tools: How We Enable

Last, how we enable the network through technology and tools will also evolve. We’ve identified three platforms to support the network based on current areas of need and future opportunities. They include:

- Higher Logic, a member experience platform that enables groups like societies to build online communities. Access to this global community will start with society leaders and staff and will eventually expand to all members. Societies will be able to connect, gather feedback, and collaborate with one another more easily.

- BillHighway is a chapter management solution purpose-built for association management that will streamline and simplify society and chapter operations for both CFA Institute and societies. We are exploring this technology and will be vetting it against other similar platforms.

- Big Commerce, an internal eCommerce platform that will be leveraged to support the society member renewal process and enable local-only membership management and growth.

Just as the remits of the groups of societies vary, so too will the society service model. Our aim is to offer a strategic suite of integrated platforms tailored to society operations at multiple levels. We will continue working with the Society Operations Advisory Council (SOAC) as well as key stakeholders in the society network as we develop our proposals and vet potential solutions.

We know that CFA Institute and societies can leverage technology and our individual strengths to create a more cohesive and comprehensive member experience, one not necessarily tied to geography. We will consult with societies on ways in which they can leverage the various platforms and use lessons learned from the Society Leader Community launch.

WHAT TO EXPECT NEXT

Putting the Society Operating Model into action will take time. Some societies can expect little change, while others may experience greater transition. We anticipate a three-year timeline to implement the role-based model and will expedite this, when and where possible. In addition to consultation opportunities in the coming months, look out for more information about:

-

Greater partnership between Society Relations, Institutional Relations, and University Relations. We are all part of Global Partnership and Client Solutions and will work closely together to advance our strategy and support societies in capitalizing on opportunities

-

Socialization of a framework for society-led development of learning products

-

Launching the Society Leader Community in Higher Logic

-

Sharing the updated Society Leader Orientation training, including a new Data Privacy training module

-

Important PCR-led governance work designed to better represent the society voice

We look forward to continuing the conversation over the coming weeks, and learning and growing together in pursuit of our shared goals.

SOCIETY MANAGEMENT

Society Databook to Retire, Replacement Resources Available

Because of a gap in resourcing, we are retiring the Society Databook until further notice. Societies who would like to access much of the information previously available in the databook can still do so through Salesforce. We have developed a resource that outlines corresponding Salesforce reports your society can run to pull data that had been included in the databooks and explains how you can begin to build historic records. Visit Society Center (Salesforce tile > Contact Data and Reporting) to access the Key Salesforce Reports resource.

MSSSA Deadline Approaching

In accordance with the Business Planning & Operating Standards process this year, we released an updated version of the Member Society Software Sharing Agreement (MSSSA). The MSSSA was published to Society Center (Standards & Funding tile → Business Planning & Operating Standards) on Friday, 29 July, and an email notification was sent to the society network. Designated society leaders (with signing authority) were contacted to electronically sign the contract using our contract management system.

Note that this document must be signed to receive your FY23 Operational Funding. The deadline to execute the agreement is Friday, 16 September 2022.

MEMBERSHIP

Member Lapse on 14 September

Thank you for your support of our 2022–2023 member renewal cycle! All non-renewed members will be updated to lapse membership status in our systems on Wednesday, 14 September. Please expect a system downtime on that date, with specific times to come. Although all join and renew member transactions will be unavailable, membership applications and candidate registrations will not be impacted.

A banner will be placed on our website alerting visitors to the downtime starting Tuesday, 13 September. We will not send communications about lapse at this time; instead, once the internal lapse process is completed, we will kick off the recovery portion of the renewal campaign. Details will follow.

CREDENTIALING AND CANDIDATE SUPPORT

August/September CFA Exam Admin Wraps Up

The August/September administration of the CFA exams wraps up today, 6 September. We look forward to releasing results throughout October and into November across all levels of the exam. Our last exam window for 2022 will take place from 15 to 21 November for Level I and 22 to 26 November for Level II.